Heritage Valley Federal Credit Union and Swaystack Position Onboarding as a Lever for Growth, Engagement, and Loyalty

With Swaystack, we can now guide members through those first critical steps, removing uncertainty and creating momentum as they move toward their goals.”

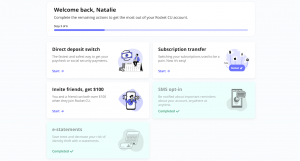

MIAMI, FL, UNITED STATES, August 26, 2025 /EINPresswire.com/ -- Swaystack today announced a partnership with Heritage Valley Federal Credit Union (Heritage Valley FCU) to ensure that every new member relationship starts strong and avoids the stall that too often follows account opening. Heritage Valley FCU selected Swaystack to embed onboarding directly into Jack Henry’s Banno digital banking platform, with single sign-on to MeridianLink for account opening and loan origination. The credit union went live in under 60 days, sunsetting a legacy onboarding system and replacing it with a guided digital journey where members already manage their money. The program is designed to deliver stronger adoption of digital banking, higher direct deposit conversion, and expanded cross-sell opportunities across the membership.— Jeremey Sterner, SVP, Strategy and Technology

Heritage Valley FCU, headquartered in York, Pennsylvania, is the oldest credit union in York County and serves members across York, Adams, Cumberland, and Dauphin counties. Founded in 1935, its mission is to help members build lasting financial heritage through service and education, always putting the prosperity of the community first.

“When someone joins Heritage Valley FCU, it’s not just about opening an account,” said Jeremey Sterner, SVP, Strategy and Technology at Heritage Valley FCU. “It’s about starting a chapter in their financial story—saving for a first home, managing a loan, or building credit for the first time. Too often, that story stalls after day one. With Swaystack, we can now guide members through those first critical steps, removing uncertainty and creating momentum as they move toward their goals. That’s how we fulfill our mission: helping every member strengthen their financial footing and, in turn, strengthening the community we all share.”

“Community institutions like Heritage Valley FCU carry more than accounts. They carry the choices members make about where to fund, borrow, and build their financial lives,” said Har Rai Khalsa, Co-Founder and CEO of Swaystack. “What their leadership has done is turn that responsibility into a plan of action. They are not waiting for members to figure it out. They are guiding them from the very first login, showing the path forward. That kind of leadership doesn’t just activate accounts. It activates loyalty, confidence, and relationships that endure for decades. That is why we are proud to partner with Heritage Valley FCU and why we built Swaystack.”

Together, Heritage Valley FCU and Swaystack are tackling a challenge every institution faces: accounts that open but never fund or engage. In today’s economy, where deposits are mobile and margins are thin, reducing friction in the first 30 days is no longer optional. By embedding guided actions directly into digital banking, Heritage Valley is ensuring that every new account has a clear path to funding and use, transforming openings into active relationships that deliver value to members and resilience to the community they serve.

About Swaystack:

Swaystack, a personalized engagement platform, is spearheaded by second-time founders who share a passion for helping banks and credit unions compete with megabank and neobank technology. Har Rai Khalsa began his career as a lender in 2007, co-founded MK Decision in 2015 to help banks and credit unions compete with digital account opening, which was acquired by Alkami in 2021. Simran Singh Co-founded Zogo in 2018. As the CTO of Zogo, he helped 250+ financial institutions gamify financial education to over 1.1 million users. Simran and Har Rai have a collective 20+ years in fintech and have served over 300+ financial institutions with the companies they’ve built.

About Heritage Valley FCU

Heritage Valley Federal Credit Union is committed to being a community-driven organization. With headquarters in York, PA, Heritage Valley has been serving members with a wide range of banking services and financial inclusion since 1935. Heritage Valley focuses on supporting local charities and creating connections to strengthen the community. To learn about Heritage Valley’s current rates and banking services, please visit heritagevalleyfcu.org.

Har Rai Khalsa

Swaystack

email us here

Visit us on social media:

LinkedIn

YouTube

Intro to Swaystack

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.